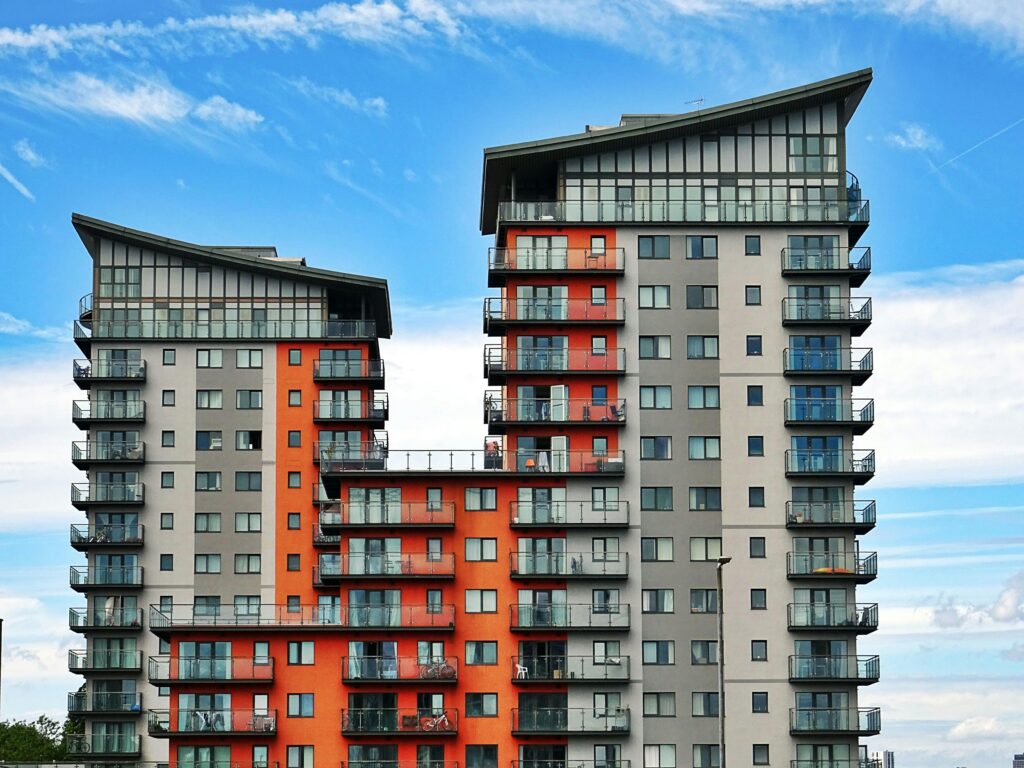

Are you looking for a smart way to build wealth and generate passive income? Investing in an apartment building could be the game-changer you need! Unlike single-family homes, apartment buildings provide multiple income streams, making them a stable and scalable investment.

But before you dive in, you need to understand the right strategies to ensure success. In this guide, we’ll break down how to invest in an apartment building step by step, covering financing options, choosing the best property, managing tenants, and maximizing profits. Whether you’re a beginner or an experienced investor, this article will help you make informed and profitable decisions in the real estate market.

Investing in an apartment building can be one of the most crucial aspects of passive income realization, building long-term wealth, and attaining financial freedom over time. What makes a multifamily building different from single-family homes is that multiple tenants are living in it, and therefore, an additional income stream is generated-mostly stable-cum-scalable investment in the future.

That said, investing in an apartment building isn’t just buying the property and collecting rent. It requires an individual to do the field research, plan, and have a robust financial plan for the successful investment scheme.

This all-too-detailed handbook will walk you through everything from why investing in an apartment building makes good financial sense to financing, managing, and growing your portfolio of real estate investments.

Why Invest in an Apartment Building?

Of course, before the “how,” we must go into the “why” of it all.

- Steady cash flow

Unlike one single family rental, when one moves out, that entire income goes away; even though one unit hasn’t been rented out, all of the apartments give you money, and that makes it a lot more constant, a little bit more predictable cash flow.

- Long-term appreciation

Real estate tends to appreciate over time. Decently located, well-maintained apartment buildings tend to appreciate greatly, allowing investors to build up wealth over the long haul.

- Tax Advantages

- Owning an apartment building includes a lot of tax benefits, such as

- We get depreciation deductions

- Interest write-offs from mortgage

- Real estate tax deductions

- Tax benefits on capital gains when you sell

- Ability to Leverage Financing

Apartment buildings are bought with bank loans mostly, and that affords you the luxury of controlling a high-value asset at a low cash outlay. This can increase your ROI dramatically.

How to Invest in an Apartment Building: Step-by-Step Guide

Now that the advantages are clear, let us see how to invest in an apartment building successfully.

Step 1: Define Your Investment Goals

Before you start looking for a property, ask yourself:

- Are you looking for cash flow or appreciation in the long run?

- How much capital can you invest?

- Are you going to self-manage, or will you hire a property manager?

- Would you like a small multi-family property (2-4 units) or a large apartment complex (50+ units)?

- Knowing your own goals will ensure you can narrow down opportunities for the best investments.

Step 2: Understand Different Types of Apartment Buildings

There are different sizes and classes of apartment buildings. Here is a quick overview:

Types of Apartment Buildings

- Small Multi-Family (2-4 units) – Easier financing, great for beginners.

- Mid-Size Apartment Buildings (5-50 units) – More complex but offer better returns.

- Large Apartment Complexes (50+ units) – Requires partnerships or syndications.

- Furthermore, apartments are categorized into Class A, Class B, Class C, and Class D based on property condition, location, and tenant quality:

- Class A: New construction, luxury amenities, and high-income tenants.

- Class B: Slightly older properties in good locations populated by lower-middle to middle-income tenants.

- Class C: Older buildings that require rehabilitation and are occupied by lower-income tenants.

- Class D: Low-income housing with an associated higher risk but potentially higher return.

On balance, for new investors, Class B and C properties are often the best buy since they are affordable yet have good rental demand.

Step 3: Find the Right Location

The area where the apartment building is located becomes crucial for the success of the investment. Areas with the following:

Strong job growth – More jobs = higher rental demand.

Growing population – More people = more renters.

Low crime rates – Tenants prefer neighborhoods that are perceived as being safe.

Good schools and amenities – These are attractive to long-term tenants.

Pro Tip: Do analyses of rental trends in your target neighborhood using online platforms such as Zillow, Redfin, or Rentometer.

Step 4: Analyze the Financials

Before the purchase of any apartment building, an analysis of the financial portfolio is paramount. Here are some things to be considered to find the following:

Key Financial Metrics

Gross Rental Income = Total Rent collected from all units.

Operating Expenses = Property Taxes, Insurance, Maintenance, and Management Fees.

Net Operating Income (NOI) = Gross Rental Income − Operating Expenses.

Cash Flow = NOI − Mortgage Payments.

Cap Rate (Capitalization Rate) = (NOI ÷ Property Price) × 100.

A higher cap rate equates to a better investment return. Most investors look for cap rates somewhere between 55%5 an10%, depending on the market.

Learn more ways to earn daily. Physical Assets to Invest In: A Smart Guide for Wealth Building

FAQs About How to Invest in an Apartment Building

1. How much money do I need to invest in an apartment building?

The amount varies, but you typically need a 20-30% down payment for traditional financing. For example, if the property costs $1 million, you may need $200,000 to $300,000 in cash.

2. Is buying an apartment building a good investment?

Yes, if done correctly! Apartment buildings provide stable cash flow, long-term appreciation, and tax benefits.

3. Can I invest in an apartment building with no money?

Yes, you can use strategies like seller financing, syndication, or private lenders to invest with little or no money down.

4. What are the biggest risks of investing in apartment buildings?

- High vacancy rates

- Unexpected maintenance costs

- Bad tenants and evictions

- Market downturns

5. Should I hire a property manager?

If you own more than 10 units, hiring a property manager (8-12% of rental income) can save you time and stress.

Final Thoughts

Learning how to invest in an apartment building is one of the best ways to create wealth through real estate. However, success depends on choosing the right property, analyzing the numbers, securing financing, and managing it properly.

If you’re serious about building long-term wealth, start researching markets, networking with investors, and exploring financing options. With the right strategy, you can turn apartment building investing into a highly profitable venture!

Pingback: Top Good Cash Flow Investments to Boost Your Passive Income and Build Wealth - Finvise Pro