The stock of Rigetti Computing (RGTI) is gaining traction among investors vying for a share in an emerging market – quantum computing. With its superconducting quantum processors, Rigetti is leading the revolution in quantum technology innovation. Investing in RGTI stock exposes you, like any investment in a disruptive technology, to risks as well as opportunities.

This article will take a deep and comprehensive review of Rigetti Computing’s stock-market performance, financial outlook, technological advancements, and long-term growth potential.

What is Rigetti Computing?

Founded in 2013, Rigetti Computing is a full-stack quantum computing company that develops quantum chips, provides cloud-based quantum computing services, and software for quantum applications. The United States’ headquarters base in Berkeley, California, provides quantum computing access through its Quantum Cloud Services (QCS) platform.

Rigetti competes against giants like IBM, Google, and D-Wave in turning practical solutions to problems for quantum computing. The phenomenal hybrid quantum-classical computing makes it unique and a player on the side.

What Other Developments Have Affected RGTI Stock?

1. New Quantum Processor

- Launch Rigetti announced, for example, in July 2023, a single-chip 84-qubit quantum processor while on its way to crossing yet another milestone in quantum technology.

- It has set the bar at exceeding the threshold of 100 qubits by 2025 for it while improving efficiency and computational power simultaneously.

2. New Leadership Changes

- In December 2022, Subodh Kulkarni was appointed as head honcho of the entire company, bringing vast experience in semiconductor and quantum technology.

- His leadership is making strides in accelerating commercial adoption and research partnerships.

3. Strategic Partnerships & Government Contracts

- In this regard, Rigetti cooperates with NASA, the U.S. Department of Energy, and many research institutions to evolve quantum computing capability.

- Increased credibility as well as stability of funding accrue to fulfilling such a contract.

RGTI Stock Performance & Financial Statistics

Historical Stock Price

- The merger through SPAC to come public on NASDAQ in 2021 nets RGTI at and around more than $10 per share.

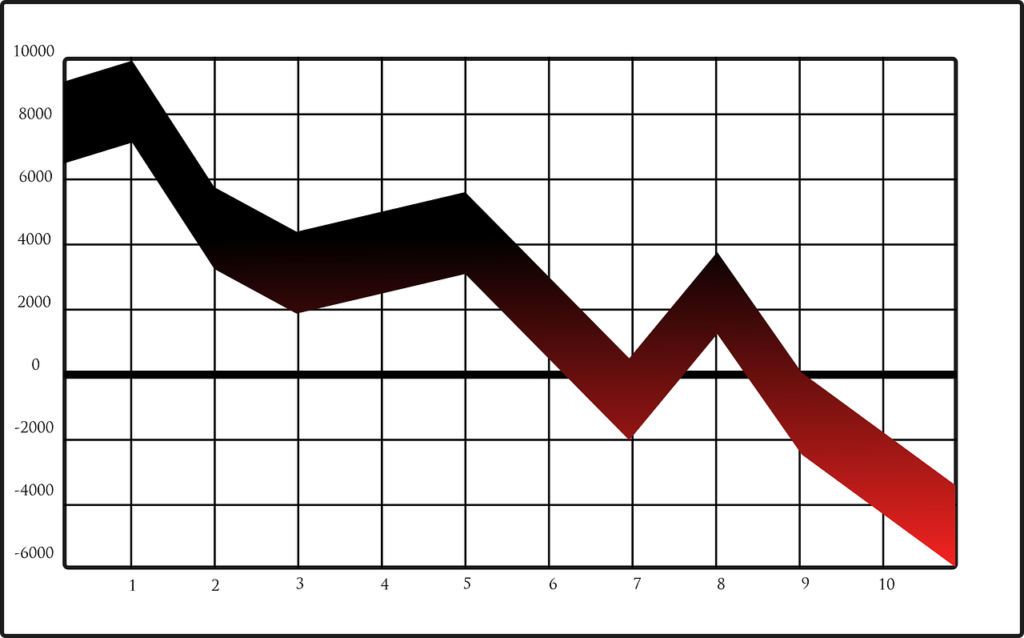

- Since then, volatility has defined the stock, alongside investor uncertainty in the quantum market.

Financial Challenges & Growth

Financial struggles and growth Cash Generated by Revenue:

Mostly from cloud-based quantum computing services or research contracts.

Cash Burn Rate: Similar to most other young technology companies, Rigetti has massive R&D expenditure and its profitability time is still far-off.

Market Cap & Valuation: As of 2025, the market cap of Rigetti fluctuates according to news, technological milestones, and investor sentiment.

The Competitive Landscape: The Position of Rigetti

Advantages

✅ Modern Technology: Superconducting qubit technology is identified as one of the most promising of quantum architectures. ✅ Strong Research Partnerships: Cooperation with government agencies, universities, and private companies increase credibility. ✅ First-Mover Advantage: As a pure-play stock in quantum computing, there is a niche market appeal for Rigetti.

Disadvantages

⚠️ Very High Competition: Competes extremely closely with IBM, Google, Amazon, and Microsoft-all of which carry research and development budgets considerably larger. ⚠️ Not Yet Profitable: Still in the investment-heavy phase with revenue scalability highly uncertain. ⚠️ Volatile Market: These stocks are highly speculative hence subject to great price swings.

Future Outlook: Is RGTI a Good Investment?

The Bullish Case for Rigetti (Growth Potential)

🚀 Quantum Computing Market Growth: It is expected that the quantum computing market will be worth $65 billion by 2030. 🚀 New Technology Development: Advancement in quantum algorithms and hybrid computing could make Rigetti a frontrunner. 🚀 Institutional Interest: The nearer quantum computing gets to its commercialization, the more institutional investors are likely to follow.

The Bearish Case for Rigetti (Risks Attached)

⚠️ Long Journey Toward Profitability: Investors are likely to have to wait a long time while Rigetti builds its technology. ⚠️ Uncertainty in Extreme Adoption: Quantum computing is years out from widespread adoption. ⚠️ Risks of Stock Dilution: Risk of further dilution as Rigetti raises more capital for R&D.

FAQs

1. Is Rigetti Computing going to be ringing the profits bell?

No, the company is still in its early stages and will not be making any money for now. Heavy investments will be made in R&D towards developing their quantum computing technology.

2. What is Rigetti Computing doing that others such as IBM and Google aren’t?

Rigetti’s focus is directing the promise that one offers in quantum computing into a real-world hybrid model for defining its practical applications. Unlike IBM and Google, which run large-scale quantum projects, Rigetti is a pure-play quantum computing stock with an in-house specialization on superconducting qubits.

3. Should I Invest Right Now in Rigetti Computing for Long-Term?

Then those parameters would depend on your risk appetite. Because quantum computing holds massive future promises, there are so many speculative aspects in the industry today. Investors should prepare themselves for lots of ups and downs and a waiting game for large-scale quantum computing adoption.

4. How Does Government Intervention Shape Future Operations of Rigetti?

Government contracts and grants provide funds for Rigetti’s credibility while allowing it the flexibility of operating. But, as a true business endeavor, Rigetti is not free from challenges that face its growth trajectory, such as regulatory challenges and changing government funding.

5. What are the issues investors should consider before buying RGTI stock?

Risks include competition with tech titans; high R&D costs; uncertain time frames to commercialization; and risk of dilution in holding because of capital raises.

Read now our this article:How U.S. Crypto Regulations in 2025 Are Reshaping the Market

Pingback: Best AI Stocks to Buy in 2025: Top Picks for High Growth - Finvise Pro